TDS/TCS Applicability on Transfer of Unlisted Shares: Sections 194Q & 206C(1H)

May 18th, 2025

Direct Tax

A. About the Author:

CA Ami Shah is associated with Ambavat Jain & Associates LLP, where she oversees Taxation and FEMA-related assignments.

She extends her heartfelt gratitude to CA Dhruv Shah, Partner at Ambavat Jain & Associates LLP, leading the Taxation and FEMA practice, for his insightful feedback and thorough review of this article. His expertise and constructive suggestions have greatly contributed to enhancing the quality and accuracy of the content.

B. Opening Note:

1. When was amendment brought in?

The concept of Tax Deduction at Source ("TDS") and Tax Collection at Source ("TCS") was introduced with an aim to collect tax from the very source of income. As per this concept, a person who is liable to make payment of specified nature to any other person shall deduct tax at source and a person who receives payment from any other person shall collect tax at source and remit the same into the account of the Central Government. But there are few transactions which may get covered under multiple sections and to find out the relevant provisions, the deductor will have to understand multiple sections with more conceptual clarity.

TDS u/s 194Q (i.e. Deduction of tax at source on payment of certain sum for purchase of goods) was introduced w.e.f. 1st July, 2021 through the Finance Act, 2021. It requires a buyer to deduct TDS at the time of making payment or crediting the amount in the account of payee whichever is earlier.

TCS u/s 206C(1H) (i.e. Collection of Tax at source on receipt of certain sum for sale of goods) introduced w.e.f. 1st October, 2020 through the Finance Act, 2020. It requires a seller to collect TCS at the time of receipt from buyer on the consideration amount for sale of any goods.

2. Confusion around applicability on sale of shares

Section 194Q mandates that any person, being a buyer, must deduct an amount equal to 0.1% of the sum exceeding INR 50 lakh as Income Tax on the purchase of any "goods." Similarly, section 206C(1H) requires any person, being a seller, to collect an amount equal to 0.1% of such sum exceeding 50 lakh Rupees as an Income-tax for the sale of any “goods”.

However, the term "goods" is not defined in the Income-tax Act, leading to ambiguity regarding its applicability to transactions involving shares and securities.

The term "goods" is defined in two key legislative acts:

i. The Sale of Goods Act, 1930; and

ii. The Goods and Services Tax Act, 2017

The term "goods" as defined in the “Sale of Goods Act, 1930” includes shares and securities. In contrast, the “Goods and Services Tax Act, 2017” excludes shares and securities from its definition of "goods."

This discrepancy raises questions about the scope of Section 194Q and 206C(1H) in relation to Shares and Securities. The term "Shares and Securities" has a broad scope. However, in this article, we are focusing exclusively on "Unlisted Equity Shares of Private Limited Companies."

The CBDT Circular Number 13/2021, dated June 30, 2021 (“Circular 13/2021”) and circular no. 17/2020, dated September 29, 2020 (“Circular 17/2020”) has specifically exempted securities and commodities which are traded through recognized stock exchanges or cleared and settled by a recognized clearing corporation from the scope of Section 194Q and 206C(1H),

Thus, as per the above Circulars, though tax would not be required to be deducted for “on market sale of shares and securities”, by implication, it would seem that all other transactions pertaining to off-market sale/ purchase of shares and securities, including shares of private and unlisted public companies, would be covered within the ambit of section 194Q or 206C(1H).

3. Ambiguity regarding tax deduction under section 194Q for Resident or Non-Resident Buyers or both

Section 194Q defines the term "buyer" as a person whose total sales, gross receipts, or turnover from the business carried on by him exceeds Rs. 10 crores during the financial year immediately preceding the financial year in which the purchase of goods is carried out. However, this provision does not specify if a buyer should be a Resident or non-resident, or both.

By way of this article, we are trying to simplify the understanding of these provisions for the readers. The objective here is to focus on presenting a simple guide for various scenarios. Thus, we have conducted an analysis on this and present the following representation.

C. Brief of Section 194Q and 206C(1H)

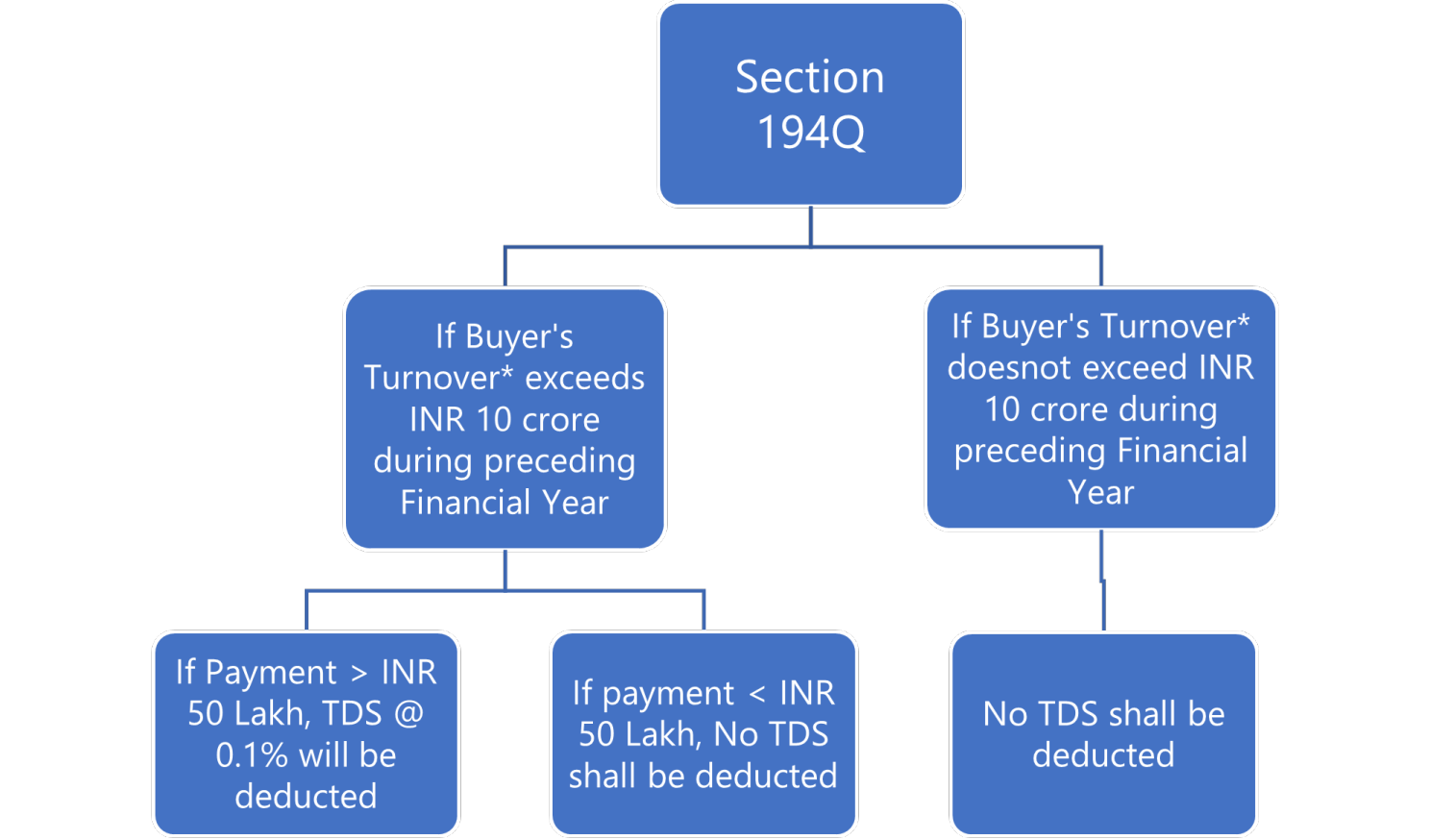

1. Section 194Q

Recently, the IT Act has been amended to introduce section 194Q, which obligates certain buyers to withhold tax on purchase of ‘goods’ from resident sellers w.e.f. July 1, 2021.

It provides that any person, being a buyer who is responsible for paying any sum to any resident seller for purchase of ‘goods’ exceeding fifty lakh rupees in a financial year is required to withhold tax. Buyer shall deduct an amount equal to 0.1 per cent of such sum exceeding fifty lakh rupees as income-tax.

*Turnover:

For the purpose of this sub-section, "Turnover" means the total sales, gross receipts or turnover from the business carried on by the buyer exceed ten crore rupees during the financial year immediately preceding the financial year in which the purchase of goods is carried out. This section defines a “person” as a buyer based on the total sales, gross receipts or turnover “from the Business carried on by that person”.

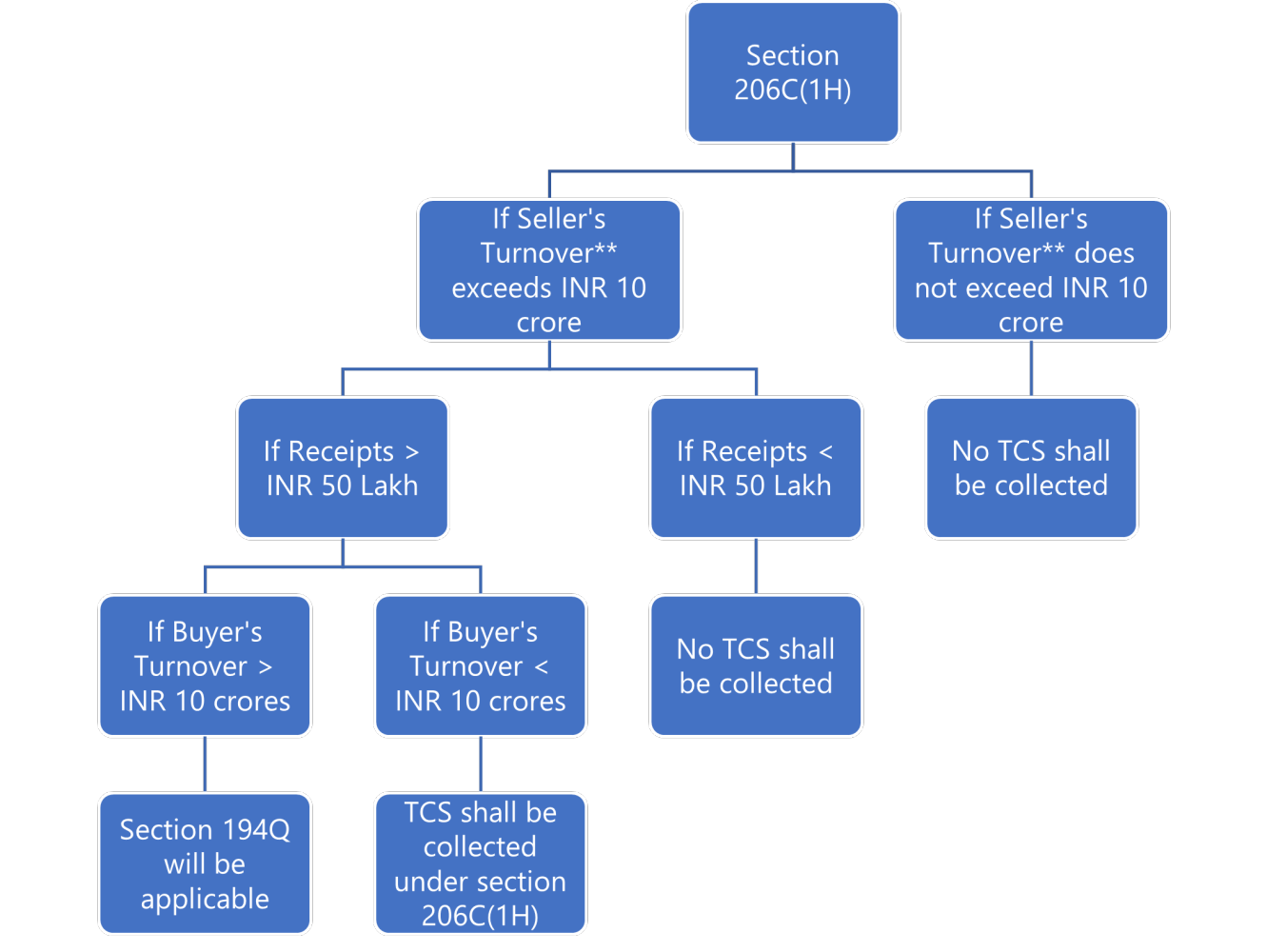

2. Section 206C(1H)

Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) of 206C shall, at the time of receipt of such amount, collect the tax from the buyer.

Seller shall collect from the buyer, a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax. If the buyer does not provide a Permanent Account Number (PAN) or Aadhaar number, the seller must collect 1% as income-tax.

**Turnover:

For the purpose of this sub-section, "Turnover" carries the same meaning as provided above under 194Q. In this context, the section defines a “person” as a seller based on the total sales, gross receipts or turnover “from the Business carried on by that person”.

3. Which Section Override

Section 206C(1H) excludes a transaction on which tax is actually deducted under any other provision (which will cover Section 194Q as well), but Section 194Q (5) does not create a similar exception for a transaction on which tax is collectible under Section 206C(1H). Thus, the buyer shall have the primary and foremost obligation to deduct the tax, and no tax shall be collected on such transaction under Section 206C(1H).

Thus, if both section 194Q and 206C(1H) are applicable, then section 194Q will supersede and no tax would be required to be collected under section 206C(1H), even if all the conditions therein are satisfied.

However, if the provisions of section 194Q do not apply to a particular transaction involving the sale of shares or securities, then section 206C(1H) may apply. Thus, it would be pertinent to analyse its applicability to the said transaction.

The Circular also provides that if, for any reason, tax has been collected by the seller under section 206C(1H) of the IT Act, before the buyer could deduct tax under section 194Q on the same transaction, then such transaction would not be subject to tax deduction again by the buyer.

CBDT has provided this concession to remove difficulty, since tax rate of deduction and collection are the same in the aforementioned sections

4. Reference of Circulars

Sub-section (3) of section 194Q of the Act empowers the Board (with the approval of the Central Government) to issue guidelines for the purpose of removing difficulties.

The Board, with the approval of the Central Government, vide Circular Number 13/2021, dated June 30, 2021 (“Circular 13/2021”) and circular no. 17/2020, dated September 29, 2020 (“Circular 17/2020”), has issued several guidelines for removing certain difficulties.

Every guideline issued by the Board under sub-section (3) shall, as soon as may be after it is issued, be laid before each House of Parliament, and shall be binding on the income-tax authorities and the person liable to deduct tax.

D. Whether “Shares and Securities” are covered in ‘Goods’

1. Brief

As mentioned above, the term ‘Goods’ is not defined in the Income-tax Act, leading to ambiguity regarding its applicability to the sale of shares and securities.

Thus, we are referring the two key legislative acts which defines the term ‘Goods’ as below:

2. Definition of ‘Goods’ as per Central Goods and Service Tax Act' 2017 (CGST Act,2017)

As per Section 2(52) of CGST Act,2017, ‘Goods’ means every kind of movable property other than money and securities but includes actionable claims, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

“securities” shall have the same meaning as assigned to it in section 2(h) of the Securities Contracts (Regulation) Act, 1956; 42 of 1956

3. Definition of ‘Goods’ as per Sale of Goods Act, 1930 (SOG Act,1930)

As per Section 2(7) of SOG Act, 1930, ‘Goods’ means every kind of movable property other than actionable claims and money and includes Stock and Shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale.

Thus, as per SOG Act,1930, ‘Goods’ includes

a. Movable property;

b. Any commodity;

c. Shares or Securities;

d. Electricity;

e. Agriculture produces;

f. Fuel;

g. Motor vehicle;

h. Liquor;

i. Jewellery or bullion;

j. Art or Drawings;

k. Sculptures;

l. Scraps;

m. Forest produce, etc.

But does not include actionable claims and money.

4. Why “Sale of Goods Act,1930” would prevail

The term 'goods' is not defined in the Income tax Act and the definition of 'goods' can be referred to from the Sale of Goods Act, 1930 for this purpose because The Sale of Goods Act, 1930 is a specific statue that deals with the 'sale of goods'.

The CBDT vide circular no. 13/2021, dated June 30, 2021 (“Circular 13/2021”), has clarified that tax under section 194Q would not be required to be deducted in cases where securities and commodities are traded through recognised stock exchanges or cleared and settled by a recognised clearing corporation, including recognised stock exchanges or recognised clearing corporation located in the International Financial Service Centre;

The CBDT vide circular no. 17/2020, dated September 29, 2020 (“Circular 17/2020”), has clarified that the provision of section 206C(1H) of the Act shall not be applicable in relation to transactions in securities and commodities which are traded through recognised stock exchanges or cleared and settled by a recognised clearing corporation, including recognised stock exchanges or recognised clearing corporation located in the International Financial Service Centre;

Thus, as per the above Circulars, though tax would not be required to be deducted for “on market sale of shares and securities”, by implication, it would seem that all other transactions pertaining to off-market sale/ purchase of shares and securities, including shares of private and unlisted public companies, would be covered within the ambit of section 194Q or 206C(1H).

Though, there is no clarity on whether the term ‘goods’ under section 194Q, includes securities or not, the Circular indirectly intends that the tax department may require buyers to withhold tax on off market sale of shares and securities by resident sellers, subject to provisions of section 194Q.

This indicates that the CBDT’s intention was to include shares and securities within the scope of "goods," and, therefore, the definition of "goods" under the Sale of Goods Act, 1930, should apply in this context.

E. Implications of applicability of 194Q and 206C(1H) in Various Scenarios

1. Points to be noted:

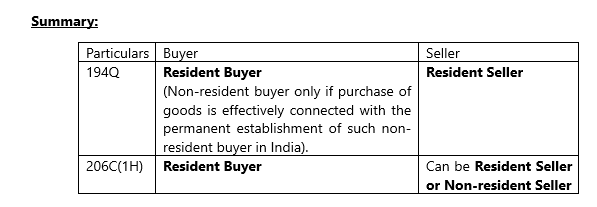

a. Section 194Q:

> Defines the term "buyer" -

o as a person whose total sales, gross receipts, or turnover from the business carried on by him exceeds Rs. 10 crores during the financial year immediately preceding the financial year in which the purchase of goods is carried out.

o This provision does not specify if a buyer should be a resident or non-resident, or both.

o However, circular no. 13/2021, dated June 30, 2021 (“Circular”) has clarified that the provisions of section 194Q, would be applicable only to resident buyers, unless the purchase is connected with the permanent establishment of a non-resident buyer in India.

o For the purpose, "permanent establishment" includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.

> Seller must be Resident.

b. Section 206C(1H):

> Buyer Means

o a Resident person who purchases any goods

o But does not include the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State, a Local Authority, a person importing goods into India or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

> Seller means

o a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

o Thus, Seller can be a Resident or Non-resident both.

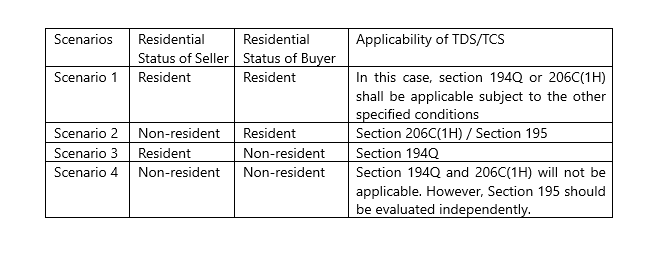

2. Scenario 1: Where Seller and Buyer both are Resident

In this case, both sections 194Q and 206C(1H) shall be applicable, subject to other conditions.

However, if both section 194Q and 206C(1H) are applicable, then section 194Q will precedence and no tax will be required to be collected under section 206C(1H), even if all the conditions therein are satisfied.

3. Scenario 2: Where Seller is Non-resident and Buyer is Resident

In this case, Section 194Q will not be applicable. However, Section 195 will apply, subject to the fulfilment of the conditions of such section.

If Section 195 doesn’t apply due to the non-fulfilment of the conditions, then Section 206C(1H) must be evaluated independently.

4. Scenario 3: Where Seller is Resident and Buyer is Non-resident

In this case, Section 206C(1H) will not be applicable, as the buyer is a non-resident.

However, Section 194Q will be applicable only if the purchase of goods is effectively connected with the permanent establishment of such non-resident buyer in India.

The question of applicability of Section 195 will not arise as in this case, payment will be made to a seller who is a resident. And Section 195 applies where the payment is made to a non-resident.

5. Scenario 4: Where Seller and Buyer both are Non-resident

In this case, both Section 194Q and section 206C(1H) are not applicable. However, the applicability of Section 195 should be examined.

6. Conclusion:

Outlined above are the four scenarios regarding the applicability of Sections 194Q and 206C(1H) based on the residential status of the buyer and seller. For ease of understanding, a summary of these scenarios is provided below:

Stay tuned for our upcoming article, where we will delve into various controversies and issues surrounding the topic discussed above.